8 Easy Facts About Tulsa Bankruptcy Consultation Described

Table of ContentsSome Ideas on Top-rated Bankruptcy Attorney Tulsa Ok You Need To KnowA Biased View of Bankruptcy Law Firm Tulsa OkTop Guidelines Of Tulsa Bankruptcy ConsultationThe 7-Second Trick For Chapter 7 Vs Chapter 13 BankruptcyTop Tulsa Bankruptcy Lawyers Can Be Fun For Anyone

The stats for the other main kind, Chapter 13, are also worse for pro se filers. (We break down the differences in between the two kinds in depth below.) Suffice it to claim, speak to a lawyer or more near you that's experienced with personal bankruptcy regulation. Right here are a couple of sources to discover them: It's reasonable that you could be hesitant to pay for an attorney when you're already under considerable financial stress.Lots of attorneys additionally provide totally free examinations or email Q&A s. Make use of that. (The non-profit application Upsolve can assist you discover cost-free examinations, sources and legal help at no cost.) Ask if insolvency is certainly the right selection for your situation and whether they believe you'll certify. Prior to you pay to submit personal bankruptcy kinds and imperfection your credit rating record for up to 10 years, check to see if you have any feasible alternatives like financial obligation arrangement or non-profit debt therapy.

Ad Now that you have actually chosen bankruptcy is undoubtedly the appropriate training course of action and you hopefully removed it with a lawyer you'll need to get begun on the paperwork. Prior to you dive right into all the main insolvency kinds, you should obtain your very own papers in order.

Facts About Chapter 13 Bankruptcy Lawyer Tulsa Revealed

Later down the line, you'll really require to verify that by divulging all type of info regarding your financial affairs. Right here's a fundamental listing of what you'll require on the road in advance: Recognizing documents like your driver's certificate and Social Protection card Tax obligation returns (as much as the previous 4 years) Evidence of earnings (pay stubs, W-2s, independent profits, earnings from properties as well as any earnings from government advantages) Bank statements and/or pension declarations Proof of worth of your possessions, such as car and realty valuation.

You'll intend to comprehend what sort of financial debt you're trying to settle. Financial obligations like kid assistance, spousal support and certain tax financial obligations can't be released (and bankruptcy can't stop wage garnishment associated to those financial debts). Pupil financing financial debt, on the other hand, is not impossible to discharge, but note that it is difficult to do so (Tulsa bankruptcy lawyer).

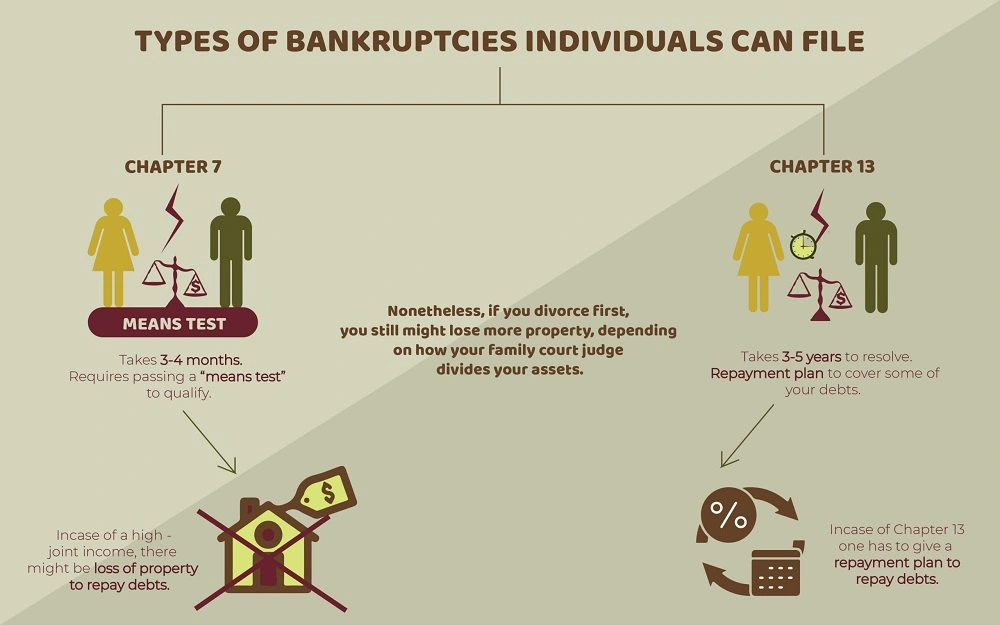

You'll intend to comprehend what sort of financial debt you're trying to settle. Financial obligations like kid assistance, spousal support and certain tax financial obligations can't be released (and bankruptcy can't stop wage garnishment associated to those financial debts). Pupil financing financial debt, on the other hand, is not impossible to discharge, but note that it is difficult to do so (Tulsa bankruptcy lawyer).If your income is too expensive, you have an additional alternative: Chapter 13. This option takes longer to settle your debts because it requires a lasting settlement plan usually three to click resources 5 years before some of your remaining debts are wiped away. The declaring process is likewise a great deal much more complicated than Chapter 7.

Not known Facts About Tulsa Bankruptcy Attorney

A Phase 7 insolvency remains on your credit rating record for 10 years, whereas a Chapter 13 personal bankruptcy falls off after 7. Prior to you submit your bankruptcy types, you must first complete a necessary training course from a credit counseling agency that has been accepted by the Division of Justice (with the remarkable exemption of filers in Alabama or North Carolina).

The program can be finished online, personally or over the phone. Programs usually set you back in between $15 and $50. You have to complete the course within 180 days of declaring for insolvency (Tulsa OK bankruptcy attorney). Make use of the Department of Justice's site to discover a program. If you live in Alabama or North Carolina, you need to choose and complete a training course from a list of individually authorized service providers in your state.

The Main Principles Of Tulsa Ok Bankruptcy Attorney

A lawyer will generally manage this for you. If you're filing by yourself, understand that there are regarding 90 different bankruptcy districts. Inspect that you're submitting with the appropriate one based upon where you live. If your long-term residence has actually relocated within 180 days of filling up, you need to file in the district where you lived the greater portion of that 180-day period.

Normally, your insolvency attorney will deal with the trustee, yet you may require to send out the individual records such as pay stubs, tax returns, and savings account and credit scores card declarations directly. The trustee who was just appointed to your situation will certainly soon establish up a compulsory conference with you, recognized as the "341 meeting" because it's a demand of Section 341 of the united state

You will require to give a timely checklist of what qualifies as an exemption. Exemptions might put on non-luxury, key automobiles; needed home goods; and home equity (though these exceptions rules can vary commonly by state). Any kind of home outside the listing of exemptions is thought about nonexempt, and if you do not offer any kind of list, then all your residential property is taken into consideration nonexempt, i.e.

You will require to give a timely checklist of what qualifies as an exemption. Exemptions might put on non-luxury, key automobiles; needed home goods; and home equity (though these exceptions rules can vary commonly by state). Any kind of home outside the listing of exemptions is thought about nonexempt, and if you do not offer any kind of list, then all your residential property is taken into consideration nonexempt, i.e.The trustee would not offer your sporting activities auto to promptly settle the creditor. Instead, you would certainly pay your financial institutions that quantity over the program of your settlement plan. A common mistaken belief with personal bankruptcy is that as soon as you file, you can quit paying your debts. While insolvency can help you eliminate a number of your unprotected debts, such as overdue clinical costs or individual financings, you'll want to keep paying your monthly settlements for safe debts if you desire to maintain the residential or commercial property.

The smart Trick of Tulsa Bankruptcy Lawyer That Nobody is Talking About

If you're at danger of repossession and have exhausted all various other financial-relief options, then declaring Phase 13 may delay the repossession and conserve your home. Ultimately, you will certainly still require the revenue to proceed making bankruptcy lawyer Tulsa future home loan payments, as well as settling any late settlements over the course of your layaway plan.

The audit could postpone any kind of financial obligation relief by numerous weeks. That you made it this far in the procedure is a good indicator at least some of your debts are eligible for discharge.